On April 2, 2025 (U.S. time), President Donald Trump officially announced a series of significant changes in U.S. trade policy, including the imposition of unprecedentedly high tariffs on multiple countries. Notably, Vietnam could face tariffs of up to 46% on goods exported to the U.S. So, where does this figure come from? NexusNovum will provide a detailed analysis in the article below.

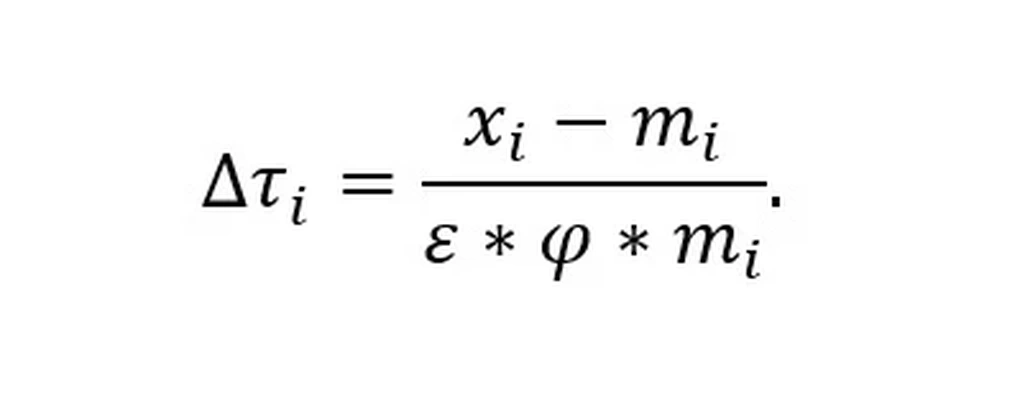

Specifically, the U.S. Office of the Trade Representative (USTR) has announced the calculation formula as follows:

Specifically:

- Δτi: is the tariff rate that the U.S. will impose as a ‘countermeasure’ to balance the trade with country i.

- xi: the export value from the U.S. to country i.

- mi: the import value of the U.S. from country i.

- ε: the percentage change in imports if the price changes by 1%. The White House has chosen ε = 4 (based on the study by Boehm et al., 2023). This means that if the U.S. increases import prices by 1%, the import volume will decrease by approximately 4%.

- φ: the portion of the tariff that is passed on to the final consumer price. The White House has chosen φ = 0.25 (based on the studies by Broda and Weinstein, 2006, and Cavallo et al., 2021). A passthrough rate of 25% means that only 25% of the imposed tariff is actually reflected in the final price paid by U.S. consumers. Consequently, 75% of the tariff must be borne by foreign exporters through a reduction in their selling prices in the U.S. market.

Applying the above formula to Vietnam, in 2024, the U.S. imported goods worth USD 136.6 billion from Vietnam (mi) but only exported USD 13.1 billion (xi), resulting in a trade deficit of USD 123.5 billion – equivalent to approximately 90% of the total bilateral trade volume.

However, we can summarize it briefly as follows:

Note: The above interpretation is correct in this case because ε * φ = 1.

Basically, this tariff directly reflects the trade deficit, with the aim of balancing the import-export relationship between the two countries.

After calculating the reciprocal tariff rate at 90.4%, the U.S. administration implemented a "discount" policy, taking half of this figure, i.e., 90.4% / 2 = 45.2%. Rounded up to 46%, this became the basis for the White House's decision to impose a 46% tariff on goods imported from Vietnam.

However, this 46% tariff does not apply to all goods exported from Vietnam to the U.S. According to Annex II of the Reciprocal Tariff Adjustment Order, certain items will be exempt, including pharmaceuticals, semiconductors, copper, raw timber, critical minerals, and some energy-related goods. For a detailed list of products exempt from the reciprocal tariff, please refer to HERE.

Certain aluminum and steel products, as well as derivative goods from aluminum and steel, automobiles, and auto parts, are also exempt from the reciprocal tariff. However, these items will still be subject to an additional 25% tariff as per the Presidential Orders dated February 10, 2025, and March 26, 2025, issued by President Trump.

Notably, key Vietnamese export items to the U.S., such as telephones, furniture, footwear, and textiles, are not included in the exemption list. This means these industries will face significant impacts from the new U.S. tariff policy.

Details regarding the U.S. tariff orders can be found HERE.

The above provides some updated information regarding the 46% reciprocal tariff that the U.S. has imposed on Vietnamese goods. NexusNovum will continue to monitor and provide further updates to our valued customers as new information becomes available.

In case you require in-depth consultation, please contact NexusNovum for detailed advice.

Note:

This article is prepared based on the current legal regulations of Vietnam and practical experience. The information in this article should only be used for reference purposes. We assume no responsibility or legal obligation to any individual or organization using the information in this article for purposes beyond reference. Before making any choices or decisions, we kindly request our valued customers to seek additional official recommendations or contact NexusNovum for in-depth advice from our experts.

Please cite the source “NexusNovum” when using or sharing this article anywhere.